Government Reaps Big: FAAC Hands Out N1.15 Trillion In February 2024

A 43% Bump: FAAC Boosts Federal, State, and Local Government Allocations

Here’s something worth talking about: the Federation Accounts Allocation Committee (FAAC) has just given the federal, state, and local governments a major financial boost. The disbursements surged by an impressive 43%, marking a significant jump in government revenue. This news comes straight from a recent publication, and it’s making waves across the country.

Obiageli Onuorah, the Acting Director of Communication & Stakeholders Management at the Nigerian Extractive Industry Transparency Initiative (NEITI), dropped this information during a press briefing in Abuja on Tuesday. She referenced the newly released FAAC Quarterly Review to back her claims.

According to Onuorah, the committee allocated a whopping ₦15.26 trillion to the three tiers of government for the period in question. She emphasized that this figure represents a new high in revenue distribution, surpassing previous records by a solid 43%.

Read also:How Much Do Our Favorite Tv Stars Earn

So, what’s driving this revenue boom? The Quarterly Review points to the Federal Government’s fiscal reform policies, particularly the removal of fuel subsidies and adjustments to foreign exchange rates. These moves have significantly boosted oil revenue remittances, creating a ripple effect that benefits all tiers of government.

During the announcement in Abuja, Dr. Orji Ogbonnaya Orji, Executive Secretary of NEITI, explained that the analyses were conducted in light of transformative fiscal reforms. He highlighted the impact of subsidy removal in mid-2023 on national and subnational finances, as well as the effects of debt repayment deductions on state allocations.

Dr. Orji added that the report aims to assess the sustainability of borrowing by federal and state governments. It also examines the implications of relying heavily on natural resources, especially for states that depend on the 13% derivation revenue from oil, gas, and solid minerals.

He noted, “Our analysis focused on crude oil revenue derivation states, as solid minerals continue to underperform despite their vast potential.”

NEITI provided a detailed breakdown of the disbursements: ₦4.95 trillion to the Federal Government, ₦5.81 trillion to State Governments, and ₦3.77 trillion to Local Governments. The total FAAC disbursements, including Derivation Revenue, reached ₦15.26 trillion.

The NEITI FAAC Quarterly Review revealed that state governments saw the largest percentage increase in 2024, climbing 62% from ₦3.58 trillion in 2023. Local government councils followed with a 47% increase, while the Federal Government’s allocation grew by 24%, rising from ₦3.99 trillion in 2023 to ₦4.95 trillion in 2024.

Read also:Meet The Worlds Richest Actresses Our Top 35 List

The report highlighted that total FAAC allocations soared by 66.2%, jumping from ₦9.18 trillion in 2022 to ₦10.9 trillion in 2023, and finally reaching ₦15.26 trillion in 2024. The most significant growth occurred between 2023 and 2024, underscoring the effectiveness of recent fiscal reforms.

What’s Behind the Revenue Surge—and the Risks

The Quarterly Review attributes the revenue surge to the government’s fiscal reforms, particularly the elimination of fuel subsidies and exchange rate adjustments. These changes have boosted naira-denominated mineral revenue by over 400%, driving the impressive numbers.

While NEITI supports these reforms and plans to keep providing reliable data, the report urges the government to implement measures to mitigate the economic and social risks associated with such changes. In transitional economies like Nigeria, these risks can be significant.

The agency identified potential challenges, including inflationary pressures, rising debt servicing costs, and fiscal uncertainties for states reliant on oil revenues. NEITI recommends that governments at all levels adopt innovative strategies to address these challenges and ensure long-term stability.

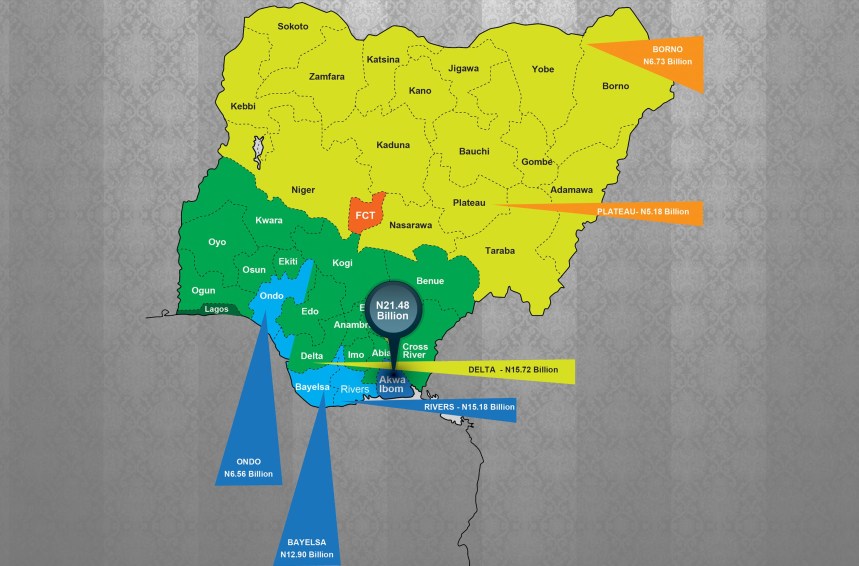

State-by-State Allocation Breakdown

The report also dived into the state-by-state allocations, revealing some interesting trends. Lagos State topped the list with ₦531.1 billion in 2024, followed by Delta (₦450.4 billion) and Rivers (₦349.9 billion). On the other end of the spectrum, Nasarawa State received the least allocation at ₦108.3 billion, with Ebonyi (₦110 billion) and Ekiti (₦111.9 billion) not far behind.

Six states—Lagos, Rivers, Bayelsa, Akwa Ibom, Delta, and Kano—each received allocations exceeding ₦200 billion, accounting for 33% of the total distributions to all states. In contrast, the six states with the lowest allocations—Yobe, Gombe, Kwara, Ekiti, Ebonyi, and Nasarawa—made up just 11.5% of the total.

The report emphasized the stark financial disparity between states. The top four states—Lagos, Delta, Rivers, and Akwa Ibom—received a combined total of ₦1.49 trillion, which is more than three times the ₦442.4 billion received by the bottom four states—Kwara, Ekiti, Ebonyi, and Nasarawa.

Total deductions for states’ foreign debts and other contractual obligations amounted to ₦800 billion, representing 12.3% of the total allocations to the 36 states, including derivation revenue.

Lagos State led the pack in debt deductions, with ₦164.7 billion deducted, accounting for over 20% of the total deductions. Kaduna State followed with ₦51.2 billion, while Rivers and Bauchi recorded significant deductions of ₦38.6 billion and ₦37.2 billion, respectively.

The report also flagged a concerning trend: numerous states with high debt ratios ranked low in FAAC allocation rankings but high in debt deductions. This raises serious questions about their debt-to-revenue ratios and overall fiscal health.

Dangote Refinery Temporarily Halts Naira Sales Amid Currency Mismatch Concerns

Controversy Erupts: Lawyer Oshoma Challenges Tinubu’s Rivers State Emergency Declaration

Nnamdi Kanu's Wife Supports His Apology To The Judiciary: A Step Toward Peace